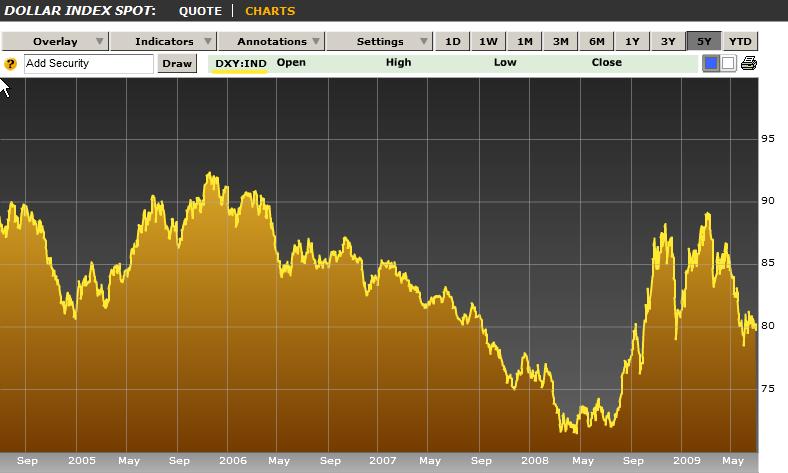

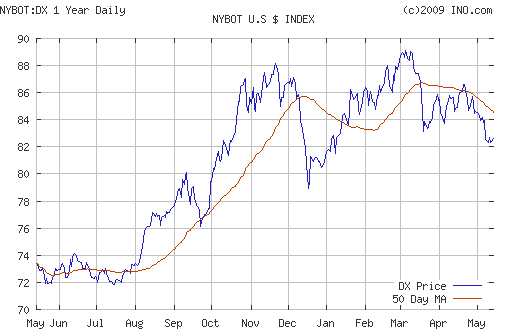

The US Dollar $ - Can Dollar Rally Continue?

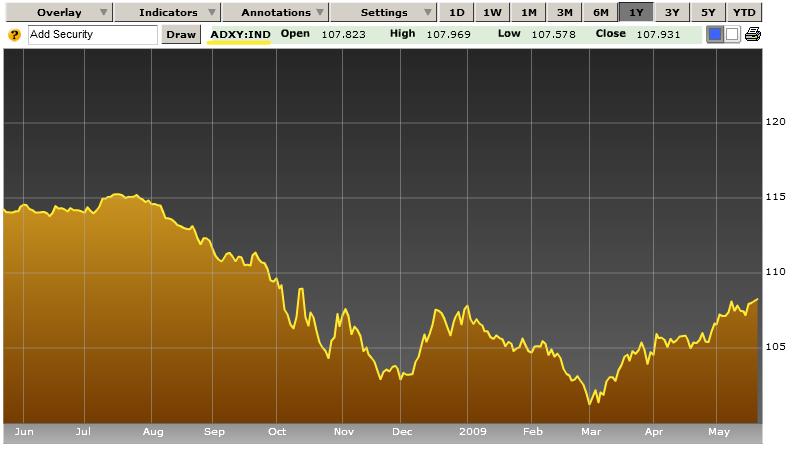

'Is the worst behind us?' we asked last week. 'If crude continues to drip lower, ' we concluded ,'it could provide yet another reason for a dollar counter trend rally.' With oil falling below $125/bbl by end of trade Friday, the massive sigh of relief from dollar bulls could be heard around the world. As a result, the greenback picked up more than 100 points on the euro by end of the week although the US economic data was mixed at best.

Housing continued to be a problem as Existing Homes plunged -2.6% versus -0.1% projected and LEI data printed negative for 7th out of the past 9 months. However by Friday US economic data actually proved supportive with U of M survey jumping back to the 60 level and Durable Goods registering a surprise increase 0.8% versus forecasts of a -0.3% decline. Furthermore as we noted in our Friday note, 'with markets already so preconditioned to bad economic news from the U.S., the greenback may not weaken much further unless the data shows substantial deterioration from the prior month.'

With the greenback clearly stabilized for now, the question forward is can the rally continue? The answer as is so often the case may depend on the NFPs'. The front of the week may actually prove dollar positive as flash GDP for Q2 could show surprising strength of 2% versus only 1% the quarter prior. However, the labor data holds the key. If NFPs surprise to the downside, most importantly breaking the -100K barrier, dollar longs will be hard pressed to rally the unit as expectations of a severe slowdown in the second half of the year will only harden the view of the bears that the worst lies ahead. -BS

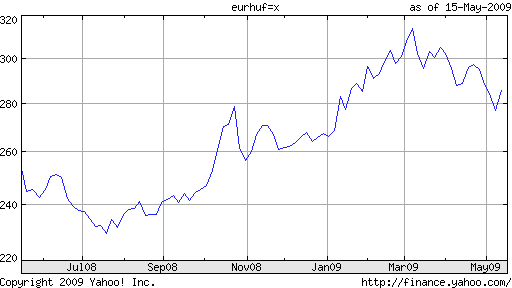

The Euro € - No Tumble Despite Trouble

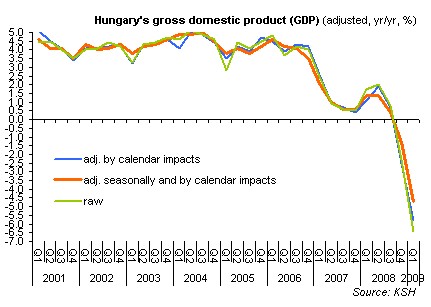

On Thursday night after the IFO numbers were released we noted, 'The IFO survey of German consumer confidence fell to a three year low piercing through the psychologically key 100 figure as it printed at 97.5 versus forecasts of 100.1. Sentiment has turned sharply lower as the German economy has finally succumbed to the triple punch combination of higher oil prices, higher interest rates and higher exchange rates.

Germany has been the primary driver of growth in the EZ and tonight's data bodes badly for the region as a whole. Earlier in the night markets saw a big plunge in French business confidence and a much larger uptick in Spanish unemployment to 10.4% indicating that the environment in the rest of the 15 member union is even worse. Given such rapidly deteriorating economic conditions its is difficult to imagine that the ECB would be willing to tighten further and risk tipping the worlds largest economic zone into a full blown recession.'

Surprisingly enough however, the EURUSD held up relatively well as the unit continues to attract safe haven flows. This appears to be the single currency's only source of strength, but for the being that may be enough to maintain the 1.55-1.60 range. The European economic calendar is relatively subdued next week with German Retail Sales and CPI estimates the only two events of note. The consumer in the region's largest economy is likely to show further weakening, but the key report may be the inflation numbers. If they jump above 4% as projected, expect more hawkish rhetoric from the ECB which could lend support to the pair. - BS

The Japanese Yen ¥ - After Yield Forecasts Curb A Carry Breakout Can USDJPY Push 108.50?

Like many of its major counterparts, USDJPY passed another week without deciding a dominate trend. Even more frustrating was the fact that a long-term buildup by the pair for a momentous breakout (in an ascending wedge) was completely deflated by a false breakouts over the past two weeks. Nevertheless, there are still key levels that still stand against the market finding a dominate direction (namely 108.50 to the upside and 104 for bears). Effectively, the quickly faded breakouts and ongoing congestion is a strong reflection of the fundamentals underlying the pair. This past week, risk appetite and carry interest were buoyed by second quarter earnings and write downs that were better than the market's severely depressed forecasts (though they were still very disappointing numbers). However, 108.00 has held out for USDJPY, and the DailyFX Carry Trade Index has pulled back from resistance, due to concerns that the outlook for yields may not compensate traders for the threat of high volatility. Such apprehension was catalyzed by the surprise RBNZ rate cut. While interest rate expectations have long forecasted a spurt of policy tightening for key low yielders (USD, EUR, CHF) and relatively staid projections for the other end of the spectrum (GBP, AUD, NZD), few were prepared to actually see differentials start to contract. As long as there are credible fears over credit and financial market conditions (not to mention the drop in capital markets), risk appetite will be a guided by expectations for returns.

Elsewhere, the economic docket was dotted by a few notable indicators that have set the tone for the health of the Japanese economy. For the first half of the week, the May All Industry Activity Index and physical trade balance for the following month added a fundamental edge to price action. The activity gauge rose for a third consecutive month, but the market's reaction was modest as most of the indicator's components were known well in advance. The smallest trade surplus in five months was a little more influential though as exports actually fell for the first time in four years - suggesting the export dependent economy could be in significant trouble with the global slowdown. Top scheduled event risk was read in the national CPI numbers for June though. Headline inflation jumped to a decade high 2.0 percent clip while even the core figure (excluding food and energy prices) was just off a 10-year high after finally crossing back above 0.0 percent.

As the coming days burn on, we will once again see little interest in the fundamental direction of the Japanese economy, though employment, household spending, consumer wages, housing and retail sales data makes for a good mix. Instead, the greatest potential for finding direction will once again fall to the meanderings of general risk sentiment and the carry trade. Second quarter earnings is essentially behind us and the Fannie/Freddie issue has more or less faded into the background. This week, the real driver for risk trends is the US data (2Q GDP, NFPs) which will act as a benchmark for global growth and thereby a barometer for monetary policy. - JK

The British Pound ₤ - Cable Keeps its Cool

The economic data form UK provided little cause for celebration as virtually all of the releases disappointed to the downside. Most notably Retail Sales dropped by 3.9% versus -2.6% expected as purchases of apparel and food declined markedly. The UK consumer is clearly feeling pinched and although the BoE monetary policy is unlikely to ease before the year end, the situation on the street is becoming more troubling by the day as demand continues to contract. As we stated in our note on Thursday, 'If the recent drop in oil prices provides a boost to spending in the fall then BoE will maintain its neutral stance. However if conditions worsen materially Mr. King and company may have to take Mr. Blanchflower's advice and lower rates quickly.'

Yet the key reason that cable displayed relative strength last week was precisely because the MPC minutes revealed a much more hawkish slat than most market participants expected. Instead of voting 8-1 to keep rates steady, the actual vote turned out to be 7-1-1 with one member voting to hike the. According to Ifrmarkets, ''Tim Besley unexpectedly voted for a 25bps hike on the grounds the BOE credibility is suffering a great deal due to overshooting inflation, and a rate hike now would help restore its reputation.'

The BoE therefore remains surprisingly stubborn in its attitude towards monetary policy but if as expected next week's data shows a continuing contraction in economic activity, the pressure on Mr. King and company to ease before the year end is likely to rise. We remain convinced that cable's 5% yield is vulnerable to a cut and therefore the 2.0000 level continues to form a relatively stiff resistance in the pair.- BS

The Swiss Franc ₣ - Inflation May Decide The Fate Of The Franc Next Week

The Swiss Franc would significantly weaken throughout the week as risk appetite increased on the back of comments from U.S. Treasury Secretary Hank Paulson and Philadelphia Fed President Charles Plosser. Paulson's reiteration of the importance of strong support from the government of the GSE's would lead to Congress passing the bill to provide a line of credit to the beleaguered GSE's. Plosser would immediately follow those comments with prepared remarks warning that U.S. monetary policy is too accommodative at present and must be adjusted prior to an economic turnaround fully taking hold or the US risks both increasing inflationary pressures and a crisis of confidence in the Federal Reserve. The remarks would spark broad based bullish dollar sentiment as markets re-priced interest rate expectations, ultimately rallying the pair over a 100 points. USDCHF would end the week rising above the 1.04 handle on the strength of a considerable improvement in U.S. Durable Goods Orders, before finding resistance

The Swiss economic docket provided very little impact on the currency's price action despite a trade report showing weakening domestic demand. The Swiss trade balance surplus widened to a record high of 2.141 billion, as demand from Asian markets offset slumping orders from the U.S. and Europe. However, declining demand fro imports demonstrates the weakening demand from consumers, who continue to see their purchasing power diminish as inflation has risen to 2.9%- the highest in 15 years. Producer and import prices rose to the highest level in 19 years rising to 4.5% following 3.9% in May, signaling that consumer prices may continue to accelerate.

Next week's calendar will provide insight into the level of inflationary pressures and its affect on consumer consumption. Indeed, Swiss consumer prices are expected to rise to 3.0% from 2.9%, as producers pass on the costs of increasing energy and raw materials. Despite , rising costs consumers have remained resilient with retail sales rebounding in May, the UBS consumption indicator will signal if demand will continue to remain firm or succumb to increasing costs. The KOF leading indicator is expected to show that the economic outlook I dimming as producers contend with slowing demand from their main trading partners. The Swiss Franc will be subject the prevailing risk sentiment which has been generating momentum with several U.S. banks reporting smaller write-downs than expected. However, many industry insiders are still expecting further fallout from the subprime crisis, which would send the pair lower. Technically the USDCHF is expected to see significant resistance until the 200 Day SMA at 104.06, which it may take aim at with continued positive earnings and the absence of credit concerns - JR

The CAD - Canadian Dollar Eyes Make-or-Break Week Ahead

Disappointments in key Canadian economic data pushed the domestic currency lower against the US dollar for the second consecutive week of trading. An ostensibly positive result in Canadian Retail Sales figures fell below analysts' bullish forecasts, and the CAD tumbled as a result. Statistics Canada reported that headline Retail spending rose 0.4 percent through the month of May-its third consecutive monthly advance. Yet the underlying picture clearly showed that the improvement in sales came on sharp rises in gasoline costs-gasoline station sales surged 2.4 percent through the period. When adjusted for prices, Retail Sales only gained 0.1 percent and year-over-year gains fell to their lowest since January, 2004.

Energy price gains likewise made their way into the most recent Consumer Price Index figures, as the headline domestic inflation rate surged to its highest in 3 years at 3.1 percent. Yet the more important Bank of Canada Core CPI figure actually remained nearly unchanged at 1.5 percent and reinforced opinions that the BoC would leave rates unchanged through the medium term. The central bank explicitly targets a Core CPI rate between 1 and 3 percent, and an inflation rate towards the lower end of its band leaves officials in a somewhat-comfortable position to leave rates as-is. It will be important to watch whether such strong headline price gains seep into the typically stable Core CPI number; the future of Canadian interest rates will depend on inflation expectations.

The week ahead will do little to clarify inflation outlook for the world's eighth largest economy, but monthly Gross Domestic Product figures will combine with an incredibly packed US economic calendar to force major volatility out of the USDCAD. Highly-anticipated US Consumer Confidence, 2nd Quarter GDP, and Nonfarm Payrolls reports are all due within a three day span-virtually guaranteeing sharp moves in US dollar pairs. Traders will clearly monitor any surprises out of forthcoming North American economic data releases; such a confluence of major news could be just what traders need to force the USDCAD out of its multi-month trading channel. - DR

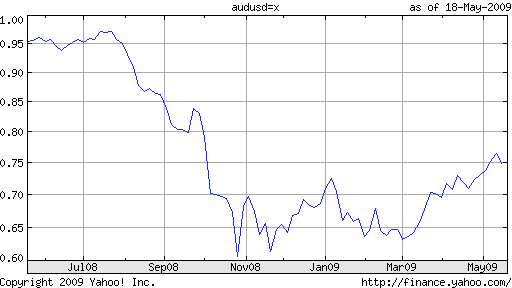

The AUD - US Dollar Sentiment to Drive the Aussie Once Again

Last week, a dual set of inflation metrics offered encouraging news to the Reserve Bank of Australia. Producer Prices eased to 4.7% in the year to the second quarter versus 5.3% expected, marking the first decline since June 2007. A conflicting report showing higher-than-expected second quarter Consumer Prices (4.5% versus 4.3% expected) failed to buoy AUDUSD the following day. This makes sense: Producer Prices is the more forward-looking of the two metrics because it takes time for producers to pass on higher production costs by charging more for finished goods. Lower producer prices in the second quarter point to an easing in consumer costs and thereby the overall inflation level in the third, making second-quarter consumer prices largely irrelevant. In the broad scheme of things, it appears RBA policy rates are indeed creating the desired disinflation that Glenn Stevens and company had hoped for. The week was rounded out with June's New Motor Vehicle Sales. We had suggested sales were 'to extend their current downtrend: high borrowing costs make cars difficult to afford while rising petrol prices make them expensive to operate.' Sure enough, the metric printed at 1.4% in the year to June, a 16-month low. On balance, the data failed to produce any meaningful impact on the AUDUSD. In forecasting last week's developments, we concluded that 'with few changes likely on the horizon in the broad macro picture of the Australian economy, AUDUSD may once again find itself trading squarely on US dollar sentiment.' This, it seems, is precisely what has happened.

Looking ahead, Australian data appears destined to follow a predictable pattern this week. June's New Home Sales figures will likely decline again having dropped -5.0% in May as deteriorating growth prospects and high borrowing costs deter consumers from committing to big-ticket purchases. Building Approvals will follow suit, with forecasts calling for an annualized decline of -4.1%. The Trade Balance may offer the single piece of silver lining to the week's otherwise dismal showing as the deficit is expected to contract to -A$100 million in June versus -A$965 million in the preceding period. May's reading was heavily skewed by a 17% rise in fuel imports as oil prices continued to soar. Imports may have eased a bit in June as consumers take stock of deteriorating economic conditions and pare back on expenses. Indeed, Westpac's measure of consumer confidence dropped -5.7% in June versus 2.7% in May. While this likely spells improvement for the trade deficit, it will mean decline for June's Retail Sales result: the headline figure is to print flat at 0.0% having grown 0.7% in May. All told, we do not expect the macro picture to deviate from established themes, meaning AUDUSD will yield to US dollar sentiment again. - IS

The NZD - Kiwi Selling To Continue As Data Heads Further South

Last week started off slow for New Zealand data as June's Credit Card Spending and Visitor Arrivals data validated our forecasts: the former metric fell to 3.3% from 5.9% in the preceding month, while the latter collapsed into negative territory to print at -1.4% versus a revised 9.1% in the previous period. We had reported that credit card receipts are 'sure to continue downward as Kiwi consumers tighten their belts amid deepening economic malaise. [Further,] while the recent weakness in the Kiwi dollar may have otherwise helped June's Visitor Arrivals, tourism surely contracted as the global slowdown takes its toll on discretionary spending the world over.'

The undisputable center-piece of the week was a surprise from the Reserve Bank of New Zealand. The deepening recession moved policymakers to cut interest rates by 25 basis points, putting benchmark borrowing costs at 8.00%. This is the first RBNZ rate cut since 2003. The accompanying release cited greater-than-expected risks to growth and tightening international credit conditions as primary catalysts for the decision. Borrowing a page from Australia's playbook, Governor Alan Bollard said that monetary policy has been 'reasonably tight for some time, and is now restraining activity and medium-term inflation pressures.' Bollard added that although recent spikes in oil and food prices will bring inflation to a peak near 5% this year, the slowing economy will act to bring price pressure to target levels in the medium term. Shaping expectations in a typically candid fashion, Bollard concluded by saying that 'provided that the outlook for inflation continues to improve and there is no excessive exchange rate depreciation, we would expect to lower the OCR further.' The Kiwi dollar responded sharply, dropping 82 pips in the first 10 minutes and continuing lower for the remainder of the week.

This week is unlikely offer anything to curtail the vigor of Kiwi bears. The Trade Balance will likely deteriorate: Oil prices continued higher in June, inflating the cost of imports while a drought likely cut into farm production to depress export volumes. Expectations call for a deficit of -NZ$350 million versus -NZ$195.8 million in May. July's edition of NBNZ Business Confidence is will almost certainly continue lower as an end to New Zealand's economic malaise is far from near. - IS

DailyFX

Disclaimer

Investment in the currency exchange is highly speculative and should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only. Accordingly we make no warranties or guarantees in respect of the content. The publications herein do not take into account the investment objectives, financial situation or particular needs of any particular person. Investors should obtain individual financial advice based on their own particular circumstances before making an investment decision on the basis of the recommendations in this website. While we try to ensure that all of the information provided on this website is kept up-to-date and accurate we accept no responsibility for any use made of the information provided. All intellectual property rights are the property of Daily FX. Daily FX and its affiliates, will not be held responsible for the reliability or accuracy of the information available on this site. The content herein is provided in good faith and believed to be accurate, however, there are no explicit or implicit warranties of accuracy or timeliness made by Daily FX or its affiliates. The reader agrees not to hold Daily FX or any of its affiliates liable for decisions that are based on information from this website. Daily FX highly recommends that before making a decision, the reader collects several opinions related to the decision and verifies facts from at least several independent sources US Currency Outlook -- Forex Currency Pairs

Forex Forecast of Major Currency Pairs

The Global-View.com Month Ahead Currency Outlook is prepared weekly by the trading professionals at GVI Forex. For information on the GVI Forex Service Click Here

At the end of week before last, it had appeared that the tone of the USD was starting to improve. It was looking a bit shakier at the start of the latest week, but then turned higher as the price of oil started to tumble. Markets feel that falling energy prices could take the pressure off key central banks, especially the ECB, to pursue a restrictive monetary policy. A less restrictive ECB could provide the USD with room to improve vs. the EUR. Recent economic data from the Eurozone suggest that the EZ economy has started to slow dramatically. This is best illustrated by the July German IFO survey data and the latest Eurozone manufacturing PMI data (both below).

It is notable that the USD survived the bail out of two massive GSE�s (Government Supported Enterprises). Fannie Mae and Freddie Mac have assets on the order of $5tln, that the government has been forced to guarantee. Although the credit crisis is by no means over, it appears that it has started to subside as a market factor. Odds are that concerns will continue to resurface periodically.

For now, the lead EUR/USD looks still to be mired in a trading range. At present levels, the EUR/USD is still fairly distant from the 1.5500 market neutrality level.