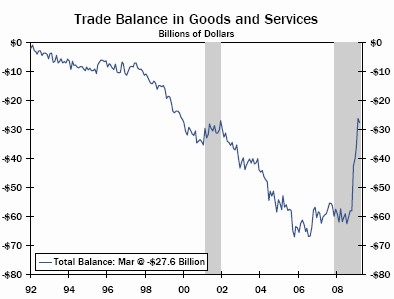

Over the last year, declines in imports and commodity prices have contributed to a veritable collapse in the US trade imbalance. While the deficit increased to $27 Billion last month, the general trend is definitely still downwards.

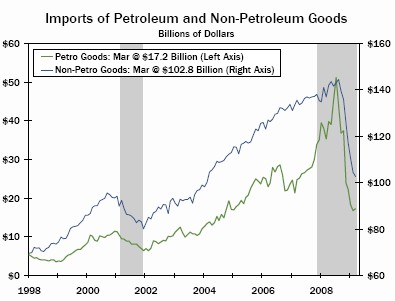

Since the inception of the credit crisis, US imports have fallen by a record 40%, on an annualized basis. In March, “Imports decreased 1 percent to $151.2 billion, the fewest since September 2004. Demand fell for industrial supplies such as natural gas and steel and for capital goods such as engines and machinery, reflecting the slump in U.S. business investment.” Lower commodity prices have also played a role on the imports side of the equation. In fact, if not for a slight uptick in energy prices, the deficit probably would have declined further this month.

Exports are also falling, but at a slower pace, such than the net effect is a more positive US balance of trade. “The 2.4% monthly fall in exports in March more than reversed the 1.5% rise the month before. But even that 2.4% drop compares well with the monthly declines of 6% plus that had become the norm since last September,” explains one economist. In other words, worldwide demand (as symbolized by US exports), is stabilizing.

Economists remain divided as to whether the trade deficit will continue to decline: “The low-hanging fruit has been achieved, and it will be difficult to narrow the trade deficit by much more going forward, especially if the vicious downturn in the economy seen in the fourth quarter and first quarter has begun to abate…..Once the economy begins to return to health in earnest (mainly a 2010 story), the trade deficit will likely begin to re-widen.” But a competing view expects “drooping consumer demand to weigh on imports and keep the trade deficit on a narrowing trend in the coming months,” in which case the deficit could fall to $350 Billion by the end of the year. Compared this to the record $788 Billion deficit of 2006!

While the balance of trade doesn’t figure directly into GDP (although it confusingly is incorporated into the expenditure method), a declining trade balance is generally reflective of a healthier economy. It implies that either exports are growing relatively faster than imports, and/or consumers are diverting more of their relative spending towards domestic consumption, both of which should contribute positively to GDP. Summarizes one economist, “If the current account did move towards balance, then it would allow the U. S. economy to probably grow at a more sustainable rate in the long term.”

The idea of sustainability (not in the environmental sense, unfortunately) is also connected to the US Dollar. Generally speaking, it is the Dollar’s role as the world’s reserve currency which has enabled the US to run a trade imbalance almost continuously for the last 30 years. In other words, trade surplus economies are willing to accept Dollars because they can be stably and profitably invested in the US. In this regard, one commentator hit the nail right on the head: “When it comes to the U.S. trade gap, how many refrigerators the U.S. sells overseas is far less important than how many dollars the rest of the world wants.”

No comments:

Post a Comment